The smart Trick of Estate Planning Attorney That Nobody is Discussing

The smart Trick of Estate Planning Attorney That Nobody is Discussing

Blog Article

The Best Strategy To Use For Estate Planning Attorney

Table of ContentsFascination About Estate Planning AttorneyMore About Estate Planning AttorneyThe Definitive Guide for Estate Planning AttorneyThe Best Strategy To Use For Estate Planning AttorneyA Biased View of Estate Planning Attorney6 Simple Techniques For Estate Planning AttorneyGetting My Estate Planning Attorney To Work

A skilled lawyer can offer beneficial assistance when managing possessions throughout one's lifetime, moving residential property upon death, and lessening tax obligations. By asking such inquiries, an individual can obtain insight into a lawyer's qualifications and figure out if they are a good fit for their certain situation. With this info, people will certainly better comprehend just how their estate plan will be handled with time and what steps need to be taken if their conditions change.It is recommended that individuals yearly assess their strategy with their attorney to ensure that all documents are precise and current. Throughout this review process, concerns concerning possession monitoring and taxes can also be dealt with. By collaborating with a seasoned lawyer that understands the needs of their customers and stays current on modifications in the law, people can feel great that their estate strategy will certainly show their dreams and goals for their recipients if something were to happen to them.

A good estate planning attorney should know the law and have a strong history in offering audio recommendations to aid customers make notified decisions about their estates. When interviewing potential estate attorneys, it is very important to ask for referrals from customers they have actually previously dealt with. This can provide valuable understanding right into their capability to establish and execute an effective strategy for each customer's distinct situations.

Little Known Questions About Estate Planning Attorney.

This may consist of preparing wills, counts on, and various other papers associated with estate preparation, providing advice on tax issues, or coordinating with various other advisors such as monetary planners and accountants - Estate Planning Attorney. It is additionally a great concept to identify if the lawyer has experience with state-specific laws or guidelines associated with possessions to make sure that all required actions are taken when creating an estate plan

When developing an estate plan, the length of time can differ significantly depending upon the intricacy of the person's situation and requirements. To make certain that an effective and detailed strategy is created, individuals must take the time to find the ideal lawyer that is experienced and experienced in estate preparation.

The files and guidelines created throughout the preparation process come to be legally binding upon the client's fatality. A qualified monetary expert, according to the dreams of the deceased, will after that begin to disperse count on possessions according to the customer's instructions. It is very important to keep in mind that for an estate plan to be efficient, it has to be properly carried out after the customer's fatality.

How Estate Planning Attorney can Save You Time, Stress, and Money.

The appointed executor or trustee must ensure that all assets are handled according to legal demands and in conformity with the deceased's dreams. This commonly entails accumulating all documents pertaining to accounts, financial investments, tax obligation documents, and various other products specified by the estate plan. Furthermore, the administrator or trustee might need to coordinate with creditors and recipients entailed in the circulation of possessions and other matters concerning settling the estate.

Individuals require to plainly recognize all facets of their estate strategy prior to it is established in motion. Collaborating with a skilled estate planning attorney can help guarantee the files are correctly prepared, and all expectations are satisfied. Furthermore, an attorney can provide insight right into just how numerous lawful devices can be used to safeguard possessions and optimize the transfer of riches from one generation to one more.

The Definitive Guide for Estate Planning Attorney

Inquire about their experience in managing complicated estates, including trust funds, wills, and other records associated with news estate planning. Learn what kind of education and learning and training they have actually gotten in the area and ask if they have any kind of specialized expertise or accreditations around. Moreover, ask about any costs associated with their solutions and determine whether these prices are repaired or based upon the job's complexity.

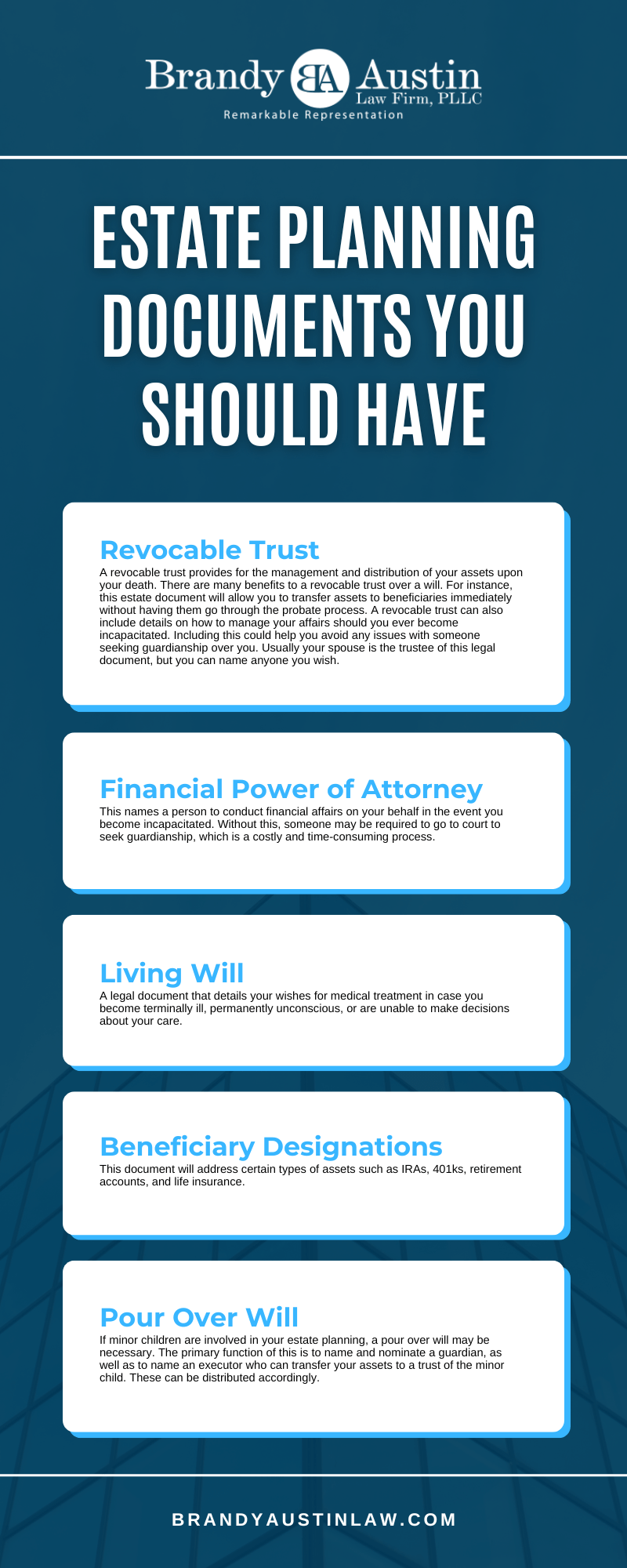

Estate planning describes the prep work of tasks that handle a person's financial circumstance in the occasion of their incapacitation or death. This planning consists of the legacy of assets to beneficiaries and the negotiation of estate tax obligations and financial obligations, along with other factors to consider like the guardianship of small children and animals.

Several of the actions include noting possessions and financial debts, reviewing accounts, and writing a will. Estate preparing jobs consist of making a will, establishing trusts, making charitable donations to restrict inheritance tax, calling an administrator and recipients, and establishing funeral setups. A will provides directions concerning residential or commercial property and protection of small youngsters.

The Of Estate Planning Attorney

Estate preparation can and must be utilized by everyonenot just the ultra-wealthy. Estate preparation entails figuring out exactly how an individual's properties will certainly be protected, managed, and dispersed after fatality. It also thinks about the monitoring of a person's homes and financial commitments in case they become incapacitated. Properties that might make up an estate consist of homes, vehicles, supplies, art, collectibles, life insurance, pension plans, debt, and extra.

Any person canand shouldconsider estate planning. There are numerous reasons that you could begin estate planning, such as preserving family wide range, offering an enduring partner and kids, moneying children's or grandchildren's education and learning, and leaving your legacy for a philanthropic reason. Writing a will is just one of the most crucial actions.

Evaluation your retired life accounts. This is very important, especially for accounts that have actually recipients connected to them. Keep in mind, any accounts with a beneficiary pass straight to them. 5. Testimonial your insurance coverage and annuities. Ensure your straight from the source beneficiary details is current and all of your other information is exact. 6. Establish joint accounts or transfer of death designations.

10 Easy Facts About Estate Planning Attorney Described

This suggests the account moves straight from the deceased to the enduring owner. A transfer of fatality designation enables you to call an individual who can take control of the account after you die without probate. 7. Select your estate manager. This individual is accountable for looking after your monetary issues after you die.

Write your will. Wills don't just unwind any kind of economic unpredictability, they can also lay out plans for your minor children and animals, and you can likewise instruct your estate to make charitable donations with the funds you leave behind. Make sure you look over whatever every couple of years and make modifications whenever you see fit.

Send out a copy of your will to your administrator. This makes sure learn this here now there is no second-guessing that a will certainly exists or that it gets lost. Send one to the person who will assume responsibility for your events after you pass away and maintain one more copy somewhere risk-free. 11. See a financial professional.

Getting My Estate Planning Attorney To Work

There are tax-advantaged financial investment automobiles you can make the most of to aid you and others, such as 529 university savings prepares for your grandchildren. A will is a lawful file that provides guidelines about just how an individual's building and protection of minor youngsters (if any) need to be dealt with after fatality.

The will likewise shows whether a trust ought to be developed after fatality.

Report this page